Services

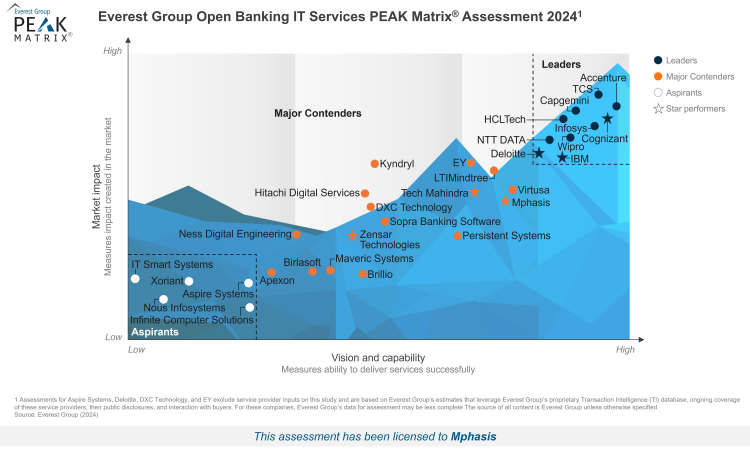

"Deep domain expertise, along with leverage of custom APIs and AI-driven solutions such as intelligent agents and accelerators in delivering open banking services, have helped Mphasis build their mark in the Open Banking IT services space in the North American region. Strong delivery capabilities, coupled with strong solutions such as risk management, a suite backed by strategic acquisitions, have helped Mphasis earn a Major Contender and Star Performer position on Everest Group’s Open Banking IT Services PEAK Matrix® Assessment 2024".

Pranati Dave, Practice Director, Everest Group

With advancement in technology reshaping customer expectations and an increasing demand for personalized and proactive suggestions gaining momentum, ensuring a deep understanding of customer data has become the need of the hour. As open banking gains prominence, data modernization becomes key to capitalize on the promise it offers.

The Everest Group’s Open Banking IT Services PEAK Matrix® Assessment 2024 evaluated 31 leading IT services providers, positioning Mphasis as a ‘‘Star Performer & Major Contender’’ in Open Banking IT Services. Mphasis earned this recognition for its strengths several key areas, Including, the use of Gen AI to optimize service delivery, AI-driven customer service bots, automated compliance systems, custom APIs, outcome-based pricing and shared risk models, among others.

|  |

At Mphasis, we leverage our deep domain industry expertise to create customer experiences that keep pace with the new-age modernization needs. We have a deep understanding of the banking domain that enables us to deliver capabilities driven by domain-driven design and new value stream needs.

Mphasis’ Open Banking IT Services are propelled by the following IPs and frameworks:

• XaaP (Everything as a Platform): A comprehensive next-gen engineering platform incorporating the latest DevOps practices in pre-built CI/CD pipelines that offers a complete technology stack for both transaction and innovation platforms.

• Intelligent agents for KYC and AML: Non-fungible agents for key functions in KYC and AML workflows trained by Mphasis based on our experience in optimizing the operations of multiple banks and financial institutions.

We have further bolstered our Open Banking IT Services with significant investments, such as, Blockchain Center of Excellence, acquisitions of Stelligent, Datalytyx, Silverline, BlinkUX, and eBECS. We also drive innovation through our dedicated innovation ecosystem comprised of NextLabs and Sparkle Labs.

Led by Mphasis.ai, we continue to invest in developing new solutions powered by AI that can accelerate the pace of AI adoption. Our new AI solutions headlining the future of AI include:

• Mphasis NeoZeta: A modernization platform that accelerates modernization of legacy applications (written in languages like COBOL, Java etc.) using Gen-AI LLMs, to reduce re-learning time by >50%.

• Mphasis NeoCrux: A modern engineering platform that offers a comprehensive ecosystem which enables digital transformation at a predictable value-based cost alongside an improved experience and security posture for enterprise clients. AI, especially Gen AI, helps with discoverability of software assets, enforcement of best practices, better collaboration and governance, and much improved automation and observability.institutions.