The specialty insurance sector is investing in digital and data capabilities, as insurers and brokers seek to modernize their operations and better meet the needs of customers. As the possibility of an economic downturn looms and the pressure to deliver greater value to stakeholders mounts, insurers are prioritizing the adoption of technologies to be more agile in their response to emerging risks, drive growth, improve experience and transform cost of operations. To achieve this, the industry is turning to next-generation technologies to improve underwriting, claims processing, and customer engagement.

Customers today demand that insurers and brokers provide hyper-personalized risk advisory and management services and cover insurance risks. Insurance premium costs too have risen due to inflation, magnifying the need for brokers and insurers to engage with their customers better. Considering the macroeconomic head winds such as inflation, high interest rates, increase in cost of living, the awareness of risks and challenges of underinsurance has increased among customers in recent times. For insurers, brokers, and Managing General Agents (MGAs), it has accelerated the need to move from product-centricity to customer-centricity. According to the 2023

Gartner

CIO and Technology Executive Survey, a majority of insurance digitalization initiatives in 2023 are primarily driven by the goal of enhancing customer experience and achieving operational excellence.

Understanding the specialty insurance market and its complexities

As a niche insurance segment, specialty insurance focuses on providing complex, non-standard, and unique risk coverage. These include political and terrorism risks or risks in the aviation or space industry. Take, for example, the insurance for marine cargo and food grain transportation from the war-hit ports of Ukraine.

Marsh

, a global leader in insurance brokerage and risk management, placed a marine cargo and war facility at Lloyd’s, a broker market to cover the complex risks involved.

Exigencies like these drive customers to seek deep risk assessment and underwriting expertise to get the appropriate coverage. Also, given the risk of consequential loss claims, it is not unusual for a consortium of Lead and Follow Insurers to jointly subscribe to portions of the risk liability. Specialty insurance plays a significant role in providing financial protection and resilience to recover from such a loss.

However, there are several parties involved, such as retail brokers, wholesale brokers, MGAs, insurers, and re-insurers, which can result in duplicate efforts and friction across the customer journey. Complexities like these can result in higher premium costs. For example, customers placing insurance requests through Lloyd’s market could see their premiums increase by 30 to 40 percent.

As a result, customers are now evaluating other markets and insurers that help provide them with risk capital at significantly lower costs. Simplifying the ease of doing business and reducing distribution costs across the value chain has become paramount.

Insurers are now using data and digital assets to reduce the cost of operations and achieve profitable underwriting. It has helped them drive value creation across customer-centric product coverage and terms, self-service, and integrated engagements across multiple engagement channels. We are now seeing a shift from a document-centric process to the use of smart data, keeping the customer journey in mind. The ability to seamlessly integrate within the ecosystem and share external data through exchanges is becoming a critical capability for specialty insurers.

Next-gen technologies to improve industry resilience

The industry is developing capabilities and adapting to change with the advances in technology trends, such as Cloud, Artificial Intelligence (AI), and Machine Learning (ML) to gain insights from data, omnichannel customer engagement, Internet of Things (IoTs), and 5G.

The use of AI/ML is also gaining popularity. Ki Insurance, a fully digital and algorithmically driven insurance firm, is transforming the Lloyd market by modernizing the broker and client experience by taking an algorithmic approach to underwriting.

IoT devices are also helping insurers do the pricing more accurately. For example, ships today can share real-time data through onboard IoT devices. Insurers can use this data combined with external information such as weather data and geo-political developments to accurately profile a vessel’s risk level on a real-time basis. It makes it possible for insurers to create new products with binding clauses where premiums are adjusted dynamically. It also gives logistic operators more flexibility to pursue more commercial opportunities. It also minimizes administration expenses for both insurers and ship operators.

As per the

Lexis Nexis Risk Solutions survey

, over 51 percent of commercial UK insurers collect data from some form of smart building technology, such as sensors. Sensors are used in shopping centers, warehouses, etc., to detect occupancy or motion, flood, or fire. However, only 11 percent believe that they are getting the full benefit from it. By maximizing smart building data, insurers can provide preventative services, accurate risk rating, and facilitate claims management.

The Mphasis approach to specialty insurance services

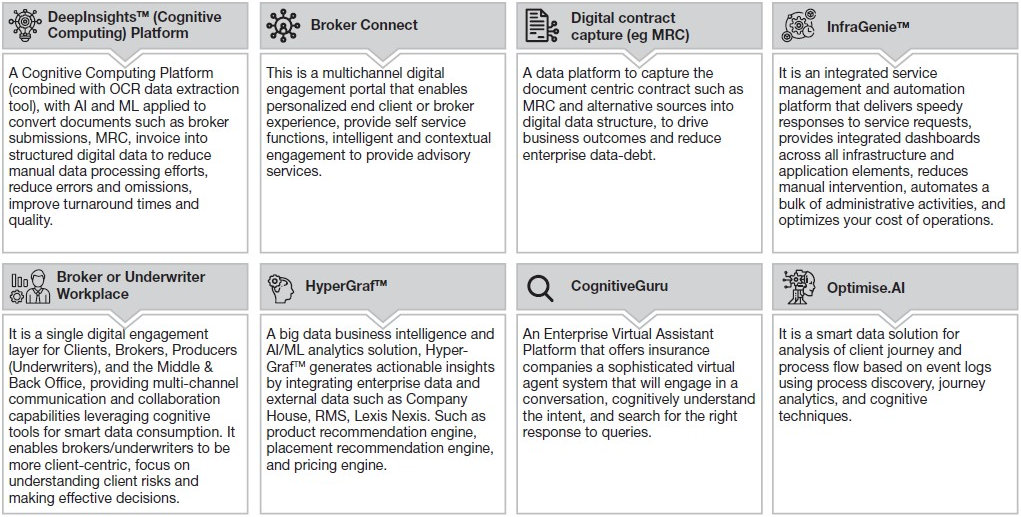

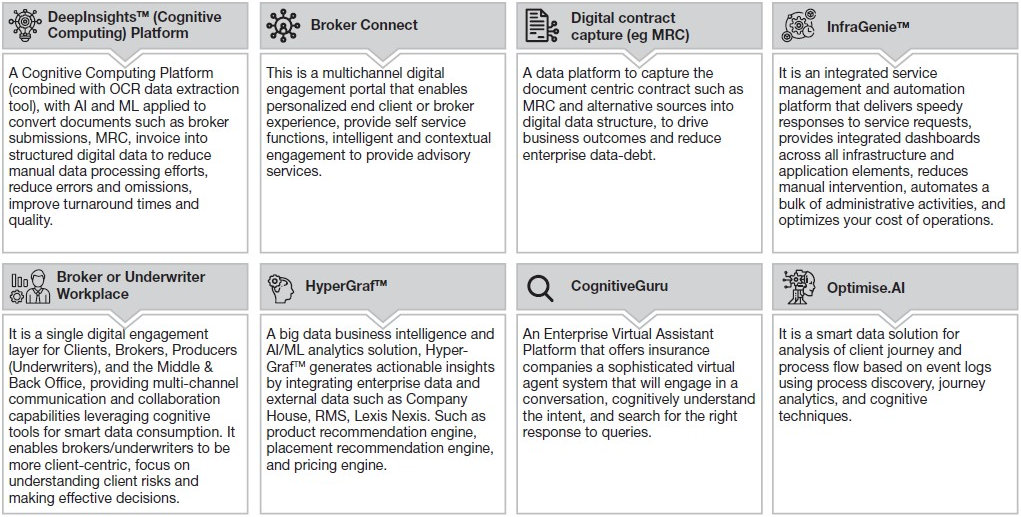

At Mphasis, we use next-gen technologies to assist specialty brokers and insurers. Our offerings include:

- Digital operations:

Following a simplified operating model enabled by intelligent automation, digital technologies, and data across multiple lines of business, which drives efficiency across the front and back-office operations.

- Digital customer engagement:

Providing business owners with solutions, such as Underwriter Workbench, Broker Connect, and digital submission management to enhance client engagement, distribution, and underwriting decisions.

- Smart data solutions:

Using insights gained from AI/ML and a combination of internal and external data, we provide a 360-degree view of the customer and their risk portfolio. We recommend the next best action, creating additional revenue streams and contributing to customer stickiness.

- Modernization of legacy systems:

Shrinking legacy core systems and modernizing them into a cloud-native landscape.

- Digital workplace platform and cloud infrastructure service management:

Accelerating the adoption of digital tools for underwriters, brokers/producers, and claims advisors to drive customer engagement while working from home office locations.

- Regulatory and compliance:

Accelerating the adoption of Lloyd’s blueprint initiatives, such as compliance to Core Data Record (CDR) and intelligent Market Reform Contract (iMRC).

Through a combination of Mphasis’s Front2BackTM

methodology and our Engineering is in our DNA approach, we have innovated and created solutions for the industry at our NEXT LabsTM

Mphasis helps clients to transform into a leading digital insurer/broker, aligned with Lloyd's change programs while following value outcomes. Our data-driven solutions optimize efficiency and cost of the rigid front and back office operating model. It infuses front-end digital client engagement capabilities for brokers, producers, and underwriters to empower them to make better decisions and in turn improve customer experience. We have witnessed up to 40 percent reduction in operation costs and an almost 20 percent improvement in underwriter/broker productivity.

The evolution of the specialty insurance sector has accelerated since the pandemic aided by advances in next-gen technologies. The tech is aiding brokers/underwriters meet not only the customer demands but also keep up with the industry changes, enabling them to expand portfolios and provide tailored products. Leveraging the right technology, however, is the key to modernizing the specialty insurance sector to navigate the next decade in insurance.