As the commercial Property and Casualty (P&C) insurance market continues to face increasingly complex and intangible risks, it has become critical for insurers to improve their underwriting discipline to increase profitability as well as reduce volatility. With geopolitical uncertainties, an inflationary environment, and a rise in risks related to cyber-attacks and catastrophic losses, it is essential for insurers to adopt effective strategies to enhance their underwriting capabilities. The aim is to stay competitive in the rapidly changing P&C insurance landscape.

Over the next decade, businesses will become riskier and more complex. The global insurance premium will more than double to USD 4.3 trillion by 2040 suggests the

Swiss Re’s Sigma report

2021. The report further expects shifts in the risk pools across motor, property, liability, and emerging risks. For example, climate risks will accelerate growth in the global property risk pool by 33 to 41 percent, generating USD 149‒183 billion of new premiums by 2040. There is however a significant opportunity for insurers to provide resilience and sustainable growth to their customers through a combination of services for risk prevention, risk management, and risk- transfer products.

Increasing expectations from underwriters

This evolving risk landscape is driving changes in customer expectations from their underwriting insurance partners. Underwriters are now expected to be risk-solution partners to their broker distribution partners and end customers. They need to provide deep-risk coverage analysis, design, and advice to their customers on a suitable risk product and provide them with information about the coverage terms and conditions.

The underwriting back-office function across the industry will continue its focus on cost efficiencies and improving operational effectiveness. There would be more efforts to automate manual and non-value-adding tasks, reduce errors and omissions, modernize legacy systems, and share service centers of practice.

Understanding the underwriter’s challenges

The risk landscape gets more complex as expectations from underwriting roles and functions continue to evolve. Often, it leads to the underwriter spending over 50 percent of their time in administration and data collection or validation tasks. This time could be spent instead on core value-adding tasks. They are dependent on work automation that enables better prioritization of work items in their quote basket.

There is a lack of collaboration tools, which makes it challenging as well as time-consuming to find the right expertise across various teams, such as risk engineering or claims adjustors and back-office support teams. It is also not uncommon for underwriters to work across different core systems to manage customer information, risk data, and analysis, quote, and policy management simultaneously.

Enhancing customer experience using next-gen tech

For underwriters, the use of Artificial Intelligence (AI) and Machine Learning (ML) helps significantly enhance core risk selection and pricing. It has a direct bearing on improving customer experience by reducing errors and omissions. Through intelligent automation, underwriters can enable enhanced customer journeys.

Advancement in maturity of technologies, such as Internet of Things (IoTs), 5G, Cloud, AI/ML, Application Programming Interface (API) Ecosystems now provides an opportunity to significantly re-imagine the work of an underwriter. Digital transformation centered on underwriting, applying a data-first mindset, and the use of AI/ML algorithms empowers an underwriter’s capabilities.

As per a recent study by

EY and ACORD (EY-ACORD 2020 US P&C insurance performance analysis)

, the top quartile P&C insurers in the US performed better than peers with Net Premiums Written Compound Annual Growth Rate (NPW CAGR) greater than 4.4 percent, average pure loss ratio greater than 55.4 percent and average total expense ratio of less than 30.2 percent. These players demonstrated sustained growth and effectively managed their expenses while balancing their risk profiles.

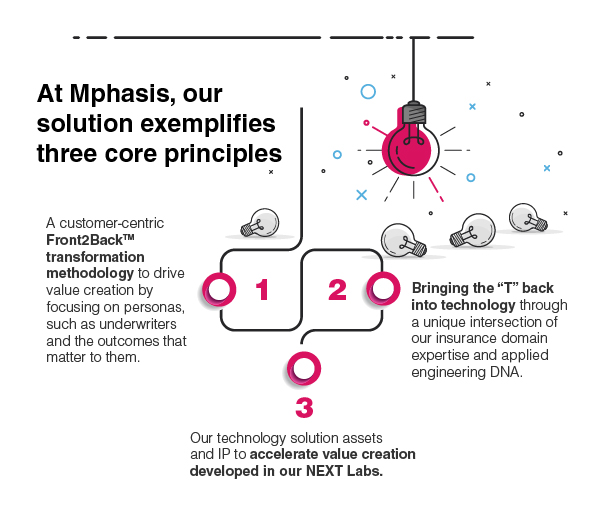

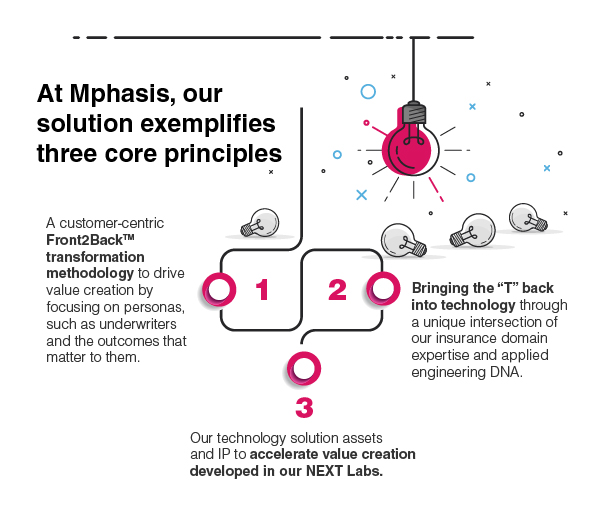

At Mphasis, our underwriter workbench provides unified and contextual access to data across multiple systems, such as Customer Relationship Management (CRM), policy administration, risk engineering reports and claims integrated with other external data subscriptions. It enables our underwriters to manage their submissions effectively recommended by a prioritization algorithm.

Our underwriter workbench helps with consistent risk selection, analysis, and pricing decisions through simple data visualizations and assisted by AI/ML algorithms providing contextual data insights and calls-to-action. The workbench incorporates intelligent workflows and business rules to aid in complying with all operational and regulatory requirements. Underwriters have an option to use a digital assistant for standard queries, access data, and knowledge of market dynamics. The workbench embeds smart collaboration tools. It also provides access to performance metrics, such as quote rate, strike rate, retention ratio, time to quote. Through these features, we have been able to achieve a 20 to 25 percent improvement in underwriter productivity.

The underwriter workbench includes assets developed in our

NEXT Labs

, such as

DeepInsights™

to convert unstructured data into digital data. Our patented

HyperGraf™

solution provides multiple AI/ML algorithms to extract insights and decide on the next-best action.

A technology empowered underwriter can function more efficiently, focus on customer-centric culture, and excel at underwriting basics. They ultimately drive profitable growth and reduce the cost of operations.