Various products are available in the market across the credit card lifecycle, including WAY4, FDR, TS2®, PRIME SM, VisionPLUS®, PowerCARD, BASE2000®, CardPac® & CardLink®.

In this blog, we discuss various Mainframe-based Credit Card products. The major products are TS2®, VisionPLUS® & Base2000®.

Before that, we will look at the different phases of the credit card product life cycle.

Various phases in the Consumer Credit Card process flow

There are five major phases in any credit product lifecycle: Product Planning, Credit Initiation, Account Maintenance, Collections, and Write-Offs.

Product Planning : This phase includes studying the target market and local conditions, the product's type, and deciding the terms and conditions for the product.

Credit Initiation : The product's design, the screening application forms, and the processing of completed forms are all part of this phase. This phase also includes whether to accept or reject specific customers and whether to extend a credit limit to them.

Account Maintenance : The product's design, the screening application forms, and the processing of completed forms are all part of this phase. This phase also includes whether to accept or reject specific customers and whether to extend a credit limit to them.

Collections : Accounts are handed over to the collections department to follow up with customers for outstanding balances. Depending on the extent of delinquency, collectors may use a variety of approaches to communicate with debtors.

Write-Offs : Accounts are closed, and any outstanding amounts are recorded as bad debts when a customer does not pay despite all attempts or the customer dies, for example.

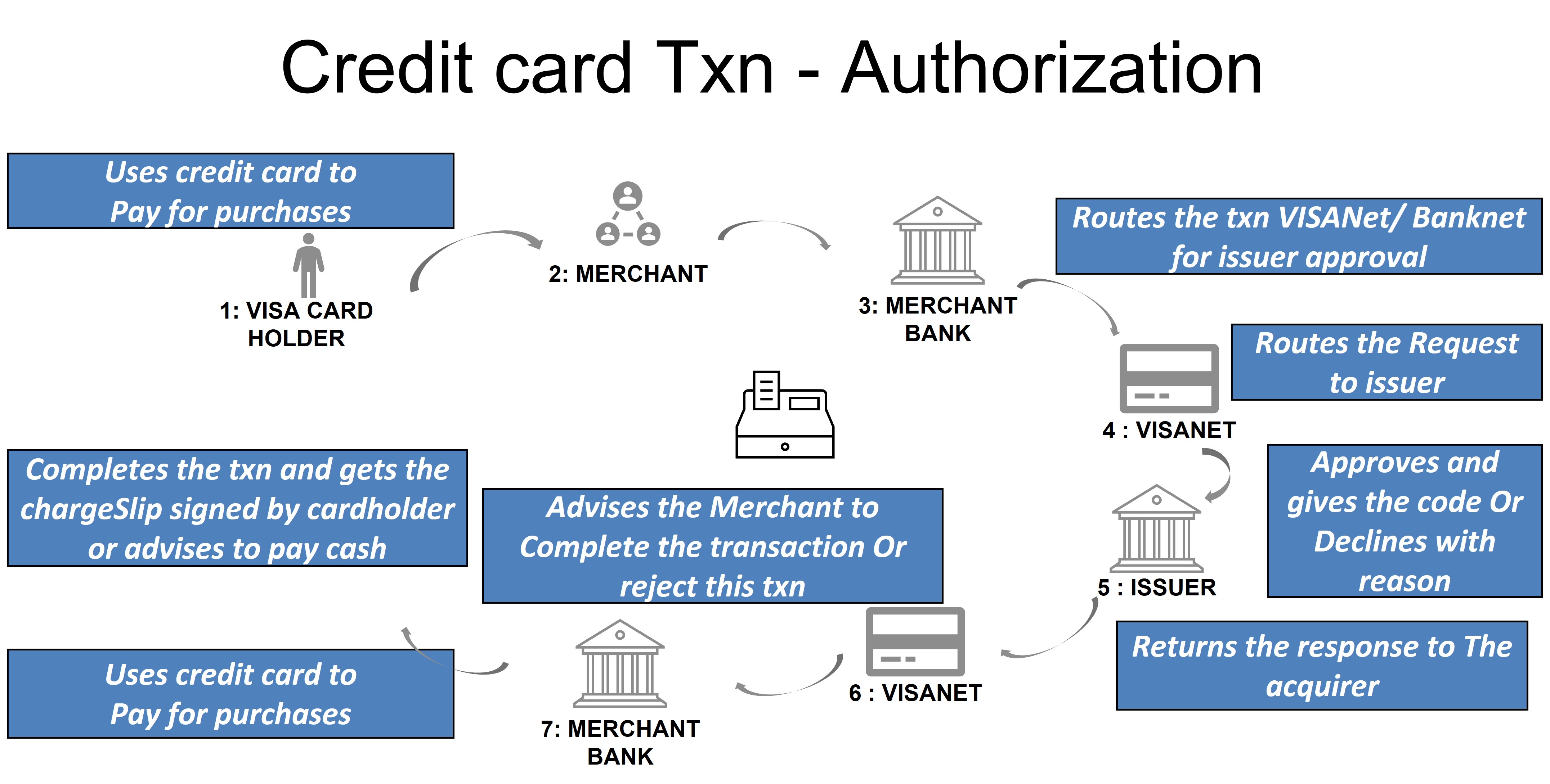

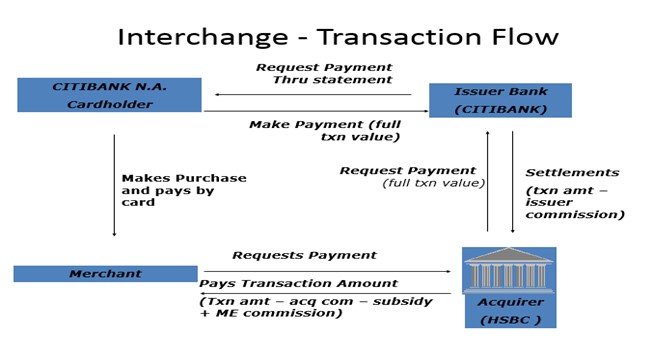

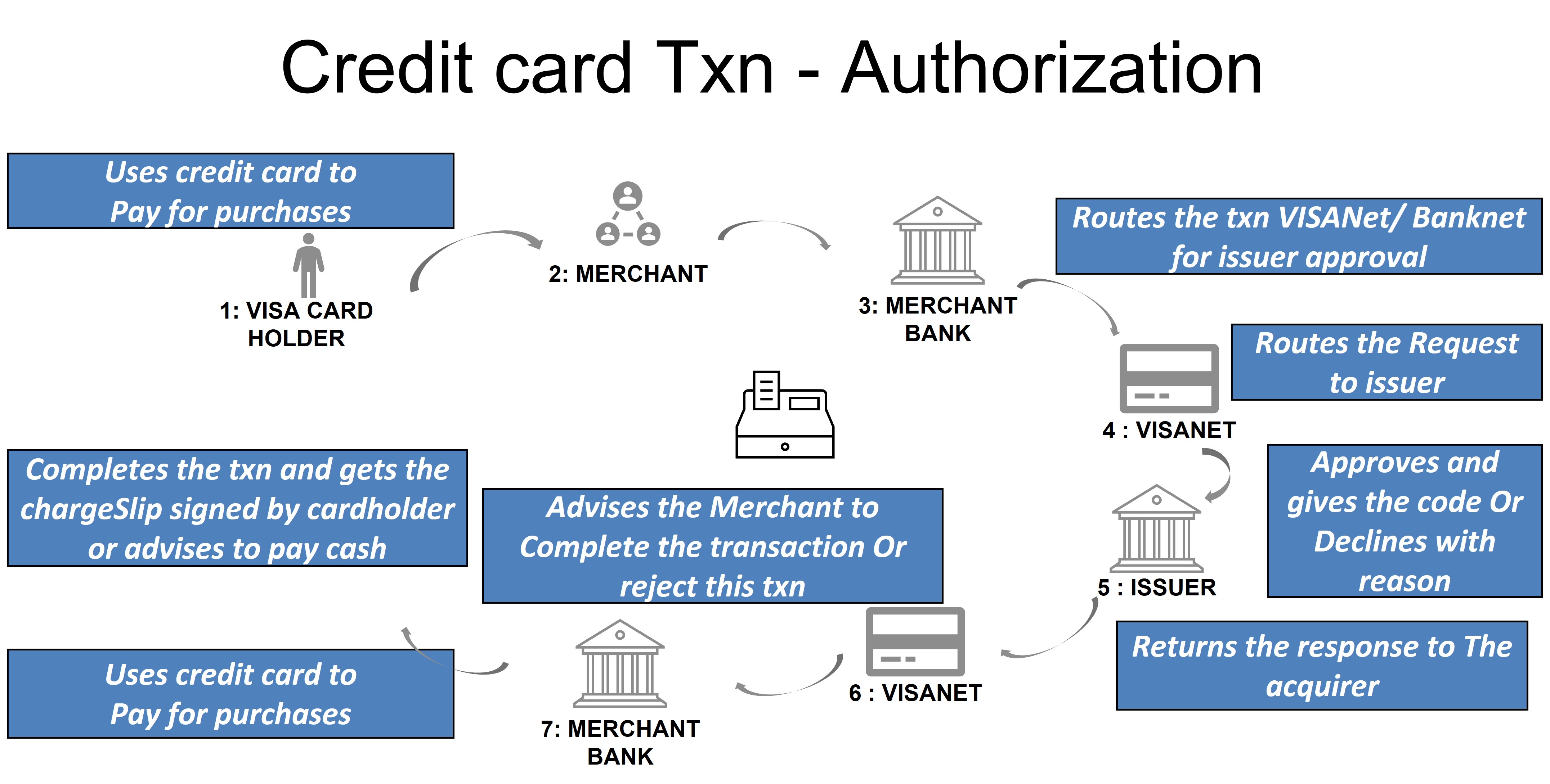

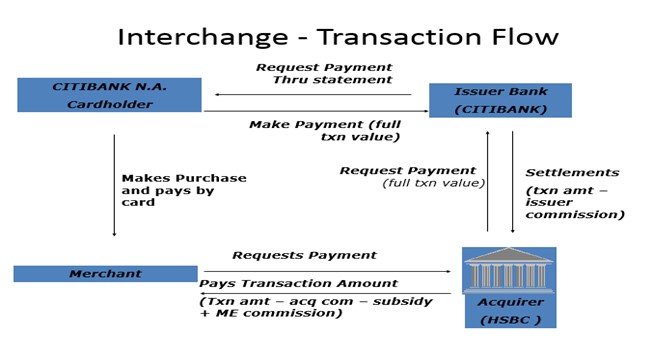

The below credit card transactions flow of authorization & settlement gives a high-level overview of the process. Most of the products need to support the various functionalities involved.

Credit Card Products

Three main mainframe-based credit card products’ highlights and key functionalities are explained below. One of the significant products is TS2®.

TS2® technology platform was developed by TSYS® (Total System Services) in 1994 to process credit cards and later upgraded to support multiple languages and currencies on a single platform. TSYS® provides payment processing, merchant, and related payment services to financial and nonfinancial institutions in the United States, Europe, Canada, Mexico, and internationally. It operates through four segments: North America Services, International Services, Merchant Services, and Net Spend. TSYS® is present in Columbus, Georgia, and United States.

TS2® provides the solution to various financial institutions such as JPMorgan Chase &Co, Citi Bank, Nationwide, RBC Royal Bank, Navy Federal Credit Union, RBS, Bank of Montreal, CIBC, and Virgin Money. It also provides solutions to the retailers such as Target, Walmart, Tesco, and Carrefour.

TS2 ® Key Features:

-

Tiered architecture: It provides online access to information at the Client Level, Account Level, Customer Level, Product Level & Transaction Level

-

The platform supports Visa, MasterCard, Discovery, PayPal, JCB, and CUP

-

Web-based credit card care module- Account maintenance, money transfer, and direct debit payment

-

Retail and private label cards - Instant application decision

-

Electronic Benefits Transfer (EBT), Gift card, Check Verification and Check Guarantee

-

Commercial Card Services - Travel, entertainment, purchasing, and fleet programs with features such as controlled authorization. merchant blocking options, flexible billing, and detailed reporting via the Internet directly into corporate accounting software

TS2® Key Modules:

-

Automated Credit Evaluation, New Account Build (ACE), Account Purge

-

Option Management System (OMS)

-

Customer Service

-

Interchange accounting system, Rewards, Insurance, Posting, Statement & Correspondence

-

Customer service via TSYS Total solutions

-

Credit bureau access, Credit bureau reporting

-

Authorization with TANDEM interface

-

TSYS Card Guard (SM), Fraud, Real-Time Decision (RTD), Score Database.

-

Security management (OTIS)

-

Collections via TSYS TDMSM

-

Report Management system (RMS)

-

Queue Management system (QMS)

-

Total Access

Technical Details - TSYS:

-

Language – COBOL (Common Business Oriented Language), JCL (Job Control Language), and Assembler.

-

Database – VSAM (Virtual Storage Access Method), DB2, IMS/DB.

-

Front End Interface – CICS (Customer Information Control System)

The following product is called VisionPLUS®, one of the most widely used products in the market.

VisionPLUS®

VisionPLUS® was introduced in late 1995 by Paysys International. Paysys has recently been acquired by a company called First Data Corp. VisionPlus® is employed by several leading financial institutions globally for payments processing and servicing. VisionPLUS® enables clients to issue, receive and process credit, debit, commercial and prepaid transactions and handle loan account processing and merchant management on a single, secure platform such as Visa, MasterCard, American Express, Europay, and private label transactions against those accounts. It has more than 600 million cards around the world. It provides solutions to various financial institutions such as Citi Bank (APAC), Royal Bank of Scotland (RBS), State Bank of India (SBI), and Axis Bank.

VisionPLUS® is a processing solution that handles retail, bankcard, and consumer loans/credits in one system. This integrated system manages all types of consumer lending products.

VisionPLUS® Key Features:

-

Custom-designed credit plans - Online control parameters with the flexibility to develop custom-designed credit plans depending on individual user requirements

-

Fully integrated system - Captures information at the point of creation, providing real-time information whatever the nature of the inquiry

-

Effective Process Authorizations - Automating decision-making and providing faster, more accurate responses. It helps track and prevents fraud

-

Targets and prioritizes collectible accounts

-

Processes receivables quickly and efficiently

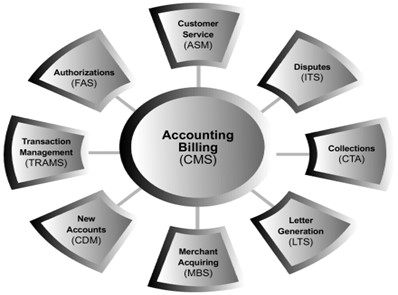

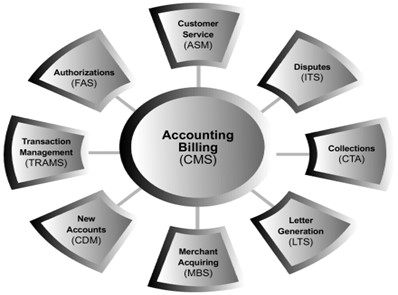

VisionPLUS® Key Modules:

Technical Details - VisionPLUS®

VisionPLUS® is available on the following three platforms:

-

AS 400

-

UNIX

- Mainframes

- Language – COBOL (Common Business Oriented Language), JCL (Job Control Language)

- Database – VSAM (Virtual Storage Access Method)

- Front End Interface – CICS (Customer Information Control System).

The final product in the discussion is BASE2000®. It is also one of the most widely used products in the market.

BASE2000 ®

Base2000® is the FIS KORDOBA card solution for issuing all kinds of credit cards. The card management system is used in many countries worldwide (USA, England, Holland, Canada, etc.). It provides the solution to various financial Institutions such as the Commonwealth Bank of Australia (CBA), Auckland Savings Bank (ASB), and RBS (Taiwan). It is a parameter-driven system. That means new products can be developed quickly and inexpensively without time-consuming programming in the software. Base2000® provides full support on a multi-language and multi-currency platform.

Base2000® is a sophisticated, mainframe-based card processing & management system by FIS used by major banks and financial institutions worldwide. It supports a variety of cards, such as bank cards, retail cards, smart cards, commercial cards, and so on.

Key Features of Base2000® :

-

Online and offline connectivity options with the Banks' host system.

-

Online connectivity with Card Scheme, providing real-time online authorizations.

-

All international debit and credit card products, including Private Label debit cards can be processed

-

Transaction-based pricing - All prices and payment options can be calculated based on the number of transactions

-

Parameter-driven system - new products can be developed quickly and inexpensively

-

Loyalty program - provides a fully integrated bonus points management system

-

GUI - Delivers an exceptionally user-friendly navigation interface

-

Switching services with the national switch in each country

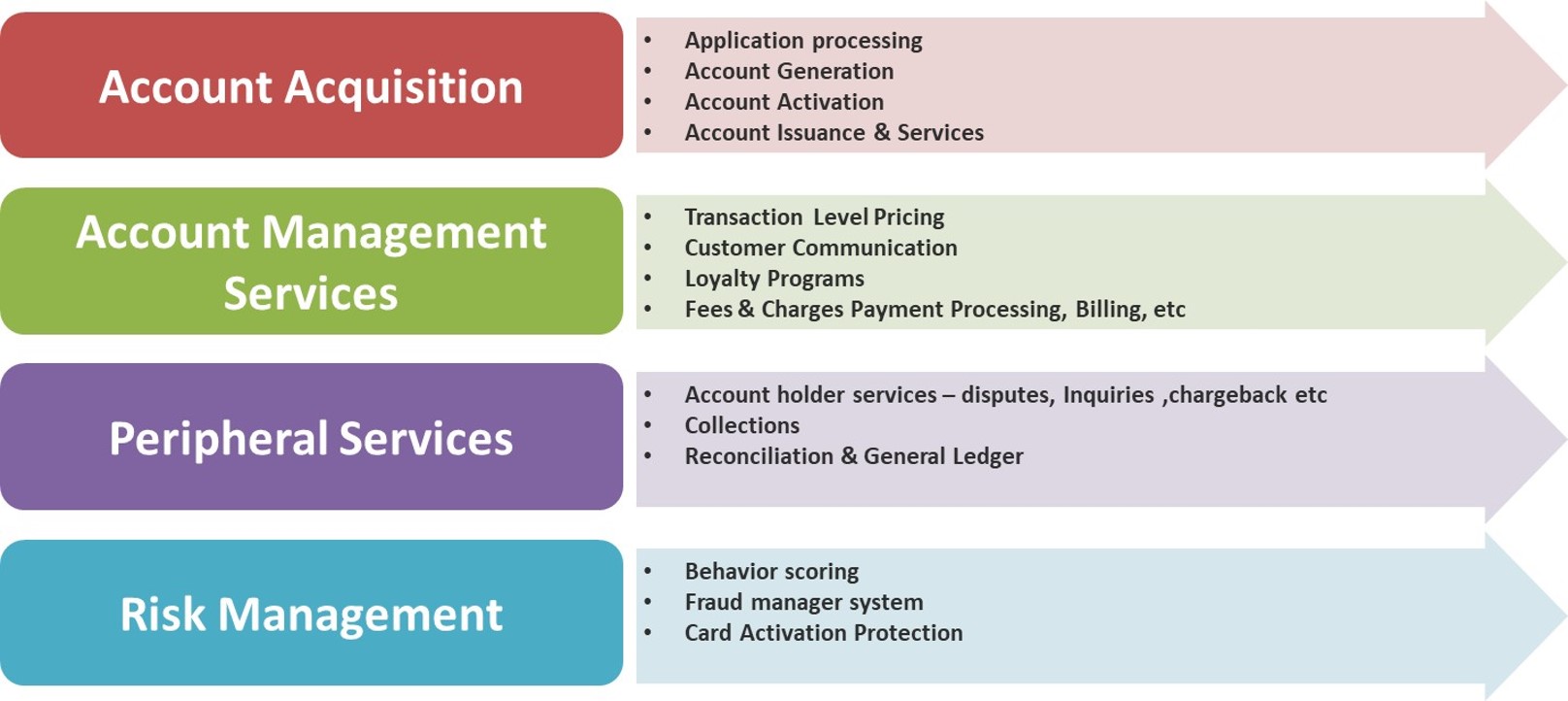

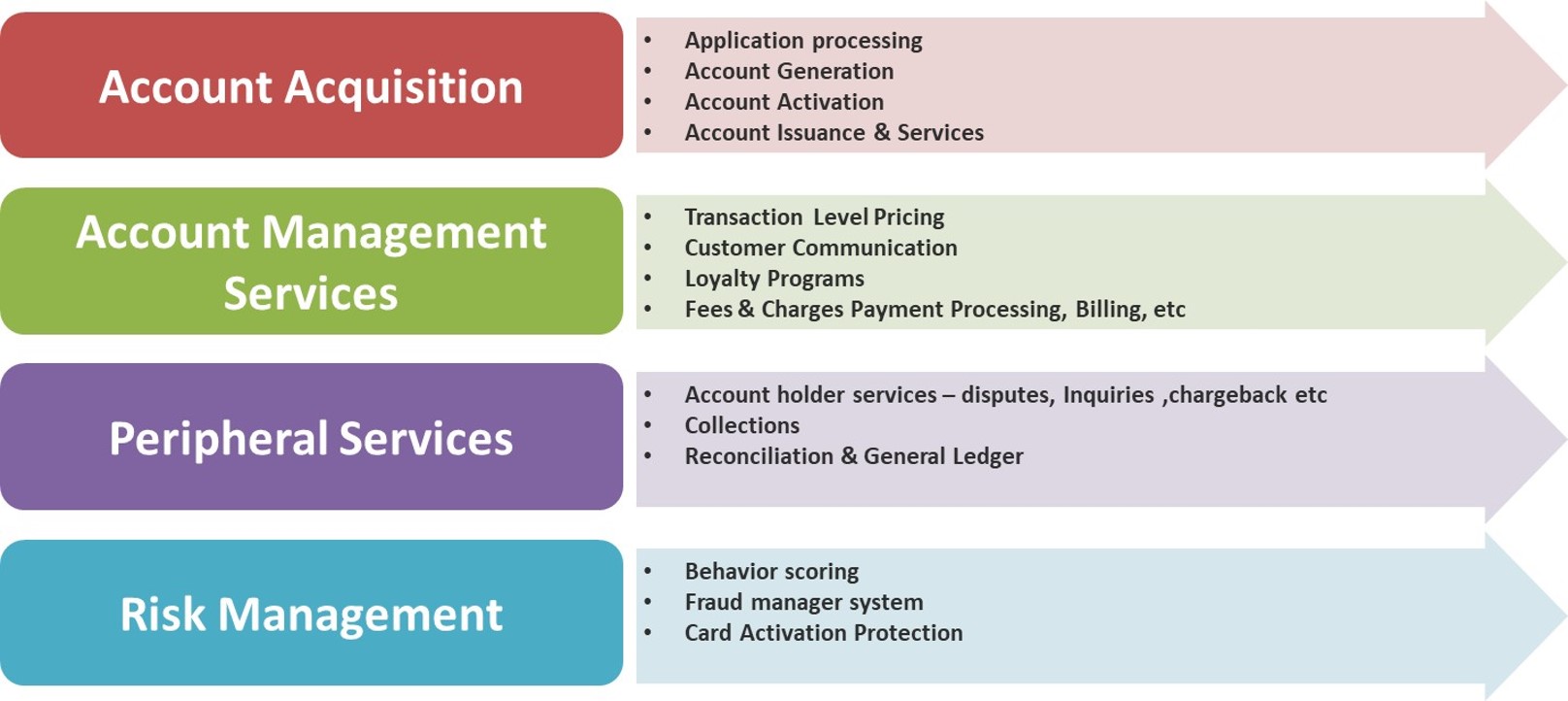

Base2000® supports end to end card lifecycle that includes :

Technical Details - Base2000

-

Language – COBOL (Common Business Oriented Language), JCL (Job Control Language), and Assembler.

-

Database – VSAM (Virtual Storage Access Method), DB2, IMS/DB.

-

Front End Interface – CICS (Customer Information Control System) & IMS/DC

Unique features of each product

-

TS2 is Option driven, whereas the others are Menu Driven. Any new product releases can be done quickly in TS2.

-

VisionPLUS® and Base2000® configuration setups are relatively simple..

-

VisionPLUS® can be implemented in AS400 and UNIX environments also.

-

TS2 & Base2000® uses IMS & DB2 databases.

New Technological advances

Today, there are more tech solutions for accepting credit cards than ever before. As a merchant services provider, TSYS stands at the forefront of credit card processing technology. It starts with credit card processing allowing a merchant to accept credit cards through a mobile device. With TSYS they can start swiping credit and signature debit cards by downloading an app to their smartphone or tablet and adding the recommended card reader. The mobile point-of-sale (mPOS) option fits the bill. It provides benefits like immediate payment authorization and lower card-present processing rates, whenever the sale arises. It can send email receipts to the customers, manage refunds and voids directly from the cell phone or mobile device. Simple, easy, direct — that's mobile credit card processing!

Another credit card processing innovation is the wireless option. Like mobile processing, wireless gives merchants and service providers the freedom to accept credit cards wherever they do business. Customers’ homes, outdoor venues, sporting events, food and beverage carts, open markets — any location where connectivity was an issue in the past is now available for business! Wireless credit card terminals slide into the merchant’s pockets.

We hope you got an overview of the market's three major mainframe-based credit card products. These products will evolve to adapt and change with the new technological advances.